Santander Select Money Market Savings | Santander Bank - Santander

Santander Select® Money Market Savings

Account details

A savings account with a competitive rate and personalized service.

For current rate information, please speak with one of our experienced Bankers.

Monthly Fee†

Select® Checking account holders

Minimum balance

ATM withdrawal fee††

- No fee to use your Santander Select® World

Debit Mastercard® at more than 30,000

Santander ATMs globally - Get up to $30 rebated per service fee period for ATM surcharge fees charged by other institutions at non-Santander ATMs

Account opening deposit

Interest

Statement delivery options

- $0 for paperless statements

- $0 for paper statements

Santander Select® Benefits

Enjoy the same great benefits as your Santander Select® Checking account

Receive Santander Select® checks, incoming wire transfers, stop payments and more.

- Enjoy Travel Protection for cancelled or delayed trips and lost or delayed luggage.2

- Access exclusive tickets and reservations with Mastercard Concierge Services.

- Travel in comfort with a complimentary annual membership to Priority Pass4.

- Shop confidently with Zero Liability3 for unauthorized purchases, Extended Warranty, Purchase Assurance, and Satisfaction Guarantee.

- For assistance with your Santander Select® World Debit Mastercard® benefits, please call 866-214-5084.

Convenience in the palm of your hand

Flexibility when you need it most

The trust you need to bank confidently

Features to effortlessly save

Our digital features make saving for your goals as easy as possible with tools like automated transfers, Alerts, and more.

Deposit with Mobile Check Deposit

Just take a picture of your signed check while you’re on the go.

Santander Safety Net

Extra leeway goes a long way. Santander Safety Net waives overdraft fees for accounts overdrawn by $100 or less.¶¶

Secure biometric authentication

Only you can unlock your information with Touch ID® and Face ID® for Apple and fingerprint for Android.††

Direct Deposit

Your employers may help with directly depositing a portion of your paycheck into your savings account.

Manage your account

Pay bills, send money with Zelle® **, make transfers and more, all from the Mobile Banking App.

Lower and fewer overdraft fees§§

We’ve lowered our overdraft fees from $35 to $15 and we’ve eliminated the Item Returned Fee. You won't be charged a Paid Item Fee more than 3 times per Business Day.

Digital Banking Guarantee‡‡

Shop online, in-store, or make bill payments with Santander PROTECHTION by your side.

Auto Save

Schedule recurring transfers from your Santander checking account or external account to keep your goals on track.

Create or update your PIN, update contact information, and report a lost or stolen card.

You won’t be charged Overdraft Protection Transfer Fees, so you can cover any overdrafts that happen before a fee gets assessed.

For digital security, our firewalls protect all your information stored in our database.

Alerts

Better manage your balance and account activity with notifications through email and text.

Bank anywhere, anytime

Manage your account whenever and wherever you want with our Mobile Banking App.

Download our

Mobile Banking App

Unlock on-the-go features with our highly-rated Mobile Banking App.

Enroll in Santander

Online Banking

Manage your money securely by enrolling in Online Banking.

FAQs: Savings

All savings accounts can be opened in a Santander Bank branch and the Santander® Savings account can be opened online. Santander® Money Market Savings, Santander Select® Money Market Savings, and Santander® Private Client Money Market Savings accounts can only be opened online in conjunction with an online checking account opening. Certificates of Deposit and Individual Retirement Accounts can only be opened in branch. To open an account, you will need:

- Your Social Security number

- A government-issued ID

- Funds for an opening deposit

- A valid email address

As long as you have everything you need, applying for a savings account online should only take 15 minutes.

You will begin to earn interest as soon as the funds in the account are available in the bank.

Yes, you can open a savings account jointly in branch or online with anyone 18 years and older, or a child under the age of 18 if you are their parent or legal guardian. Learn more about joint savings and joint checking accounts.

Interest accrues daily and is credited to your account monthly.

How much could my savings be worth?

See how your deposits can contribute to greater savings over time.

Read more

Emergency savings

Are you prepared for an emergency? Discover the importance of emergency savings to your financial future.

Read more

Money market vs. savings

Learn about the differences between a money market savings account and a savings account to see which one is right for you.

Read more

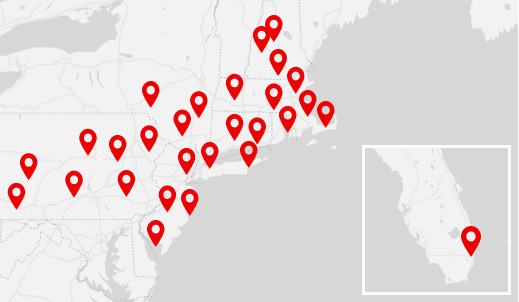

Find Us

Find Us

*Rates are available for new money market customers only. This is a variable-rate account and the rate applicable to your balance tier may change at any time without notice. Rate is available when account is opened or located in a Santander location within the ZIP code entered. If ZIP code entered is not located in CT, DE, MA, NH, NJ, NY, PA, RI, or select areas in Florida: Miami-Dade, Monroe, Broward counties, and Collier county ZIP Code 34141, rates shown may not be available. Rates in other locations may vary. Rates may not be available for online openings. Fees may reduce earnings. A minimum deposit of $25 is required to open a Santander Select® Money Market Savings account. Personal accounts only. Must have or open a Santander Select® Checking account. All other fees apply. For more information about applicable fees and terms, refer to the Personal Deposit Account Fee Schedule or visit your local branch.

†Each monthly service fee period begins on the day service fees, if any, are calculated and posted to your account and ends on the day before your service fees are next calculated and posted.

‡For detailed information, please review the Personal Deposit Account Fee Schedule.

2See Guide to Benefits that comes with your card.

3You must properly safeguard your PIN and promptly notify us of any unauthorized transactions. Please refer to Your Liability for Unauthorized Transfers section in your Personal Deposit Account Agreement.

4With Priority Pass Membership, there is an entry fee per lounge visit.

**U.S. checking or savings account required to use Zelle®. Transactions between enrolled consumers typically occur in minutes and generally do not incur transaction fees. In order to send payment requests or split payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

††If you share your device with other individuals, please note any fingerprints or face image stored on your device may be used to log in to the Santander Mobile Banking App and access your account.

‡‡Digital Banking Guarantee: When you use Online Banking, we guarantee that your money is protected against online fraud or losses and that your bills will be paid on time. You are protected against unauthorized online transactions as long as you check your statement and promptly notify us of any unauthorized activity. Refer to your Digital Banking Agreement for details on guarantees and your responsibilities for promptly reporting unauthorized transactions, as well as a list of supported mobile devices.

§§If a transaction causes your account’s balance to be overdrawn by one hundred dollars ($100) or less, we will not assess any Insufficient– Item Paid fee(s) for that item. The amount of the Insufficient Funds – Item Paid Fee and Sustained Overdraft Fee is $15. A Sustained Overdraft Fee applies to accounts overdrawn by any amount (negative balance) for five (5) consecutive Business Days when the overdrawn balance at the end of the first day is more than $100, and is assessed to the account on the sixth (6th) Business Day. Fees may be imposed for covering overdrafts created by check, in-person withdrawal, ATM withdrawal, or other electronic means. Whether overdrafts will be paid is discretionary and we reserve the right not to pay. For example, we typically do not pay overdrafts if your account is overdrawn for an extended period of time or the overdrawn amount is excessive. Any overdrafts that we pay must be promptly repaid by you.

¶¶We limit withdrawals and transfers out of your savings and money market savings accounts. You can withdraw or transfer funds from a savings or money market savings account a total of six (6) times per Service Fee Period (such as by automatic or pre-authorized transfers using telephone, online banking, mobile banking, overdraft protection, payments to third parties, wire transfers, checks, and drafts). If you repeatedly exceed these limits, we may close or convert your account to a checking account, which may be a non-interest-bearing checking account.

Apple, the Apple logo, Apple Pay and Touch are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries.

§Securities and advisory services are offered through Santander Investment Services, a division of Santander Securities LLC. Santander Securities LLC is a registered broker-dealer, Member FINRA and SIPC and a Registered Investment Adviser. Insurance is offered through Santander Securities LLC or its affiliates. Santander Investment Services is an affiliate of Santander Bank, N.A.

| INVESTMENT AND INSURANCE PRODUCTS ARE: | |||||

| NOT FDIC INSURED | NOT BANK GUARANTEED | MAY LOSE VALUE | |||

| NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY | NOT A BANK DEPOSIT | ||||

Schedule one-on-one time with a banker.

Schedule one-on-one time with a banker. Equal Housing Lender - Member FDIC

Equal Housing Lender - Member FDIC